You signed in with another tab or window. Reload to refresh your session.You signed out in another tab or window. Reload to refresh your session.You switched accounts on another tab or window. Reload to refresh your session.Dismiss alert

Liquidator can acquire collateral assets for free or significantly less.

Summary

Under function liquidateDefaultedLoanWithIncentive, the liquidator can pay zero due to the following code. Look at line 730, the value to transfer can be zero if tokensToGiveToSender is equal to amountDue.

File: LenderCommitmentGroup_Smart.sol

721: } else { // if minamount difference is less than or equal to zero722:

723:

724: uint256 tokensToGiveToSender =abs(minAmountDifference);// returns 1 if x is negative 1, return zero if zero725:

726:

727: IERC20(principalToken).safeTransferFrom(

728: msg.sender,

729: address(this),

730: amountDue - tokensToGiveToSender // this can be zero if tokenstogivetosender is equal to amount due 731: );

Then, let's illustrate on how this can be possible. We need to first study the function of minamountdifference (see below) in which this will act as multiplier. As you can see, there is a chance this can result of -100% of amount due. Look at line 822-825. If amount due is 100, this function can result to -100.

File: LenderCommitmentGroup_Smart.sol

801: function getMinimumAmountDifferenceToCloseDefaultedLoan(

802: uint256_amountOwed, // let say 1803: uint256_loanDefaultedTimestamp804: ) publicviewvirtualreturns (int256amountDifference_) {

805: require(

806: _loanDefaultedTimestamp >0,

807: "Loan defaulted timestamp must be greater than zero"808: );

809: require(

810: block.timestamp> _loanDefaultedTimestamp,

811: "Loan defaulted timestamp must be in the past"812: );

813:

814: uint256 secondsSinceDefaulted =block.timestamp-815: _loanDefaultedTimestamp;

816:

817: //this starts at 764% and falls to -100% 818: int256 incentiveMultiplier =int256(86400-10000) -819: int256(secondsSinceDefaulted);

820:

821: if (incentiveMultiplier <-10000) {

822: incentiveMultiplier =-10000;

823: }

824:

825: amountDifference_ =826: (int256(_amountOwed) * incentiveMultiplier) /827: int256(10000);

828: }

Then let's go back again at this code snippet below, remember the result is -100 amount due for minamount difference, this can be turn positive in line 724, and then will deducted in line 730 (100-100 = 0). So the value of transfer is zero. Simply put the liquidator able to acquire collateral for free.

File: LenderCommitmentGroup_Smart.sol

721: } else { // if minamount difference is less than or equal to zero722:

723:

724: uint256 tokensToGiveToSender =abs(minAmountDifference);// returns 1 if x is negative 1, return zero if zero725:

726:

727: IERC20(principalToken).safeTransferFrom(

728: msg.sender,

729: address(this),

730: amountDue - tokensToGiveToSender // this can be zero if tokenstogivetosender is equal to amount due 731: );

Root Cause

The root cause pertain to the formula below in line 730, it simply allows the amountdue to be reduce to zero and transfer zero tokens. The tokenstogivetosender computation should be revise also and not allow to deduct significantly to the amount due.

File: LenderCommitmentGroup_Smart.sol

721: } else { // if minamount difference is less than or equal to zero722:

723:

724: uint256 tokensToGiveToSender =abs(minAmountDifference);// returns 1 if x is negative 1, return zero if zero725:

726:

727: IERC20(principalToken).safeTransferFrom(

728: msg.sender,

729: address(this),

730: amountDue - tokensToGiveToSender // this can be zero if tokenstogivetosender is equal to amount due 731: );

The getMinimumAmountDifferenceToCloseDefaultedLoan computation should also be revise and not allow to fall to -100%. The allowed discount should be minimal only like 1-10% of amount due.

817: //this starts at 764% and falls to -100% 818: int256 incentiveMultiplier =int256(86400-10000) -819: int256(secondsSinceDefaulted);

820:

821: if (incentiveMultiplier <-10000) {

822: incentiveMultiplier =-10000;

823: }

824:

Internal pre-conditions

Liquidator need to execute liquidation at the point since default in which the value of minamountdifference is significant negative value of amount due. So execution can be at range of 85,400-86,400 seconds since default time. If the execution is at exact 86,400 seconds since default, 100% guaranteed that the value transfer or payment by liquidator is zero.

External pre-conditions

No response

Attack Path

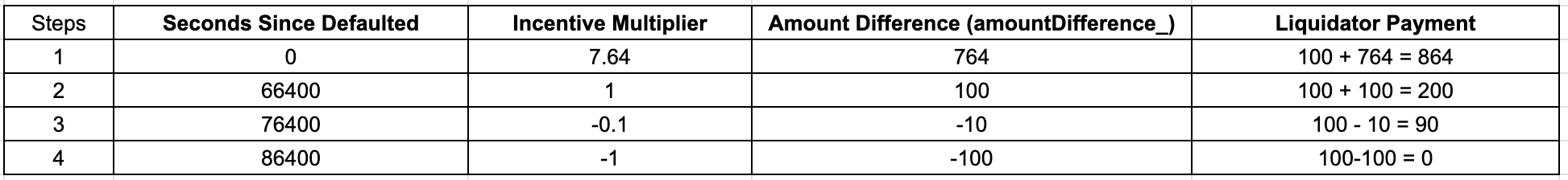

This can be the scenario. Let's say the amount due is 100 tokens. Please be reminded i did not include here the protocol fees to simplify the liquidator payment

At initial phase of liquidation, 864 is the total payment due to high multiplier

Decrease of multiplier , decrease also of total payment due

The amount difference is negative, so the else statement in liquidation function will trigger. This will give discount to total amount due.

If the liquidator execute liquidation at final second of 86400, which means 100% negative of amount due, therefore zero payment.

Impact

The liquidator can acquire the collateral assets for free or significantly less in which the lenders will receive nothing or very minimal in exchange.

PoC

No response

Mitigation

Revise the formula in getMinimumAmountDifferenceToCloseDefaultedLoan which should not give significant discount to the amount due. The allowed discount should be minimal only like 1-10% of amount due.

The text was updated successfully, but these errors were encountered:

Restless Magenta Mallard

High

Liquidator can acquire collateral assets for free or significantly less.

Summary

Under function liquidateDefaultedLoanWithIncentive, the liquidator can pay zero due to the following code. Look at line 730, the value to transfer can be zero if tokensToGiveToSender is equal to amountDue.

Then, let's illustrate on how this can be possible. We need to first study the function of minamountdifference (see below) in which this will act as multiplier. As you can see, there is a chance this can result of -100% of amount due. Look at line 822-825. If amount due is 100, this function can result to -100.

Then let's go back again at this code snippet below, remember the result is -100 amount due for minamount difference, this can be turn positive in line 724, and then will deducted in line 730 (100-100 = 0). So the value of transfer is zero. Simply put the liquidator able to acquire collateral for free.

Root Cause

The root cause pertain to the formula below in line 730, it simply allows the amountdue to be reduce to zero and transfer zero tokens. The tokenstogivetosender computation should be revise also and not allow to deduct significantly to the amount due.

The getMinimumAmountDifferenceToCloseDefaultedLoan computation should also be revise and not allow to fall to -100%. The allowed discount should be minimal only like 1-10% of amount due.

Internal pre-conditions

External pre-conditions

No response

Attack Path

This can be the scenario. Let's say the amount due is 100 tokens. Please be reminded i did not include here the protocol fees to simplify the liquidator payment

Impact

The liquidator can acquire the collateral assets for free or significantly less in which the lenders will receive nothing or very minimal in exchange.

PoC

No response

Mitigation

Revise the formula in getMinimumAmountDifferenceToCloseDefaultedLoan which should not give significant discount to the amount due. The allowed discount should be minimal only like 1-10% of amount due.

The text was updated successfully, but these errors were encountered: